Becoming a millionaire at 30 but facing a swift downfall: Former friend testifies against Sam Bankman-Fried in court

Two years ago, Sam Bankman-Fried was a 30-year-old billionaire living in a $35 million penthouse in the Bahamas. At that time, Bankman-Fried was running one of the world’s most valuable cryptocurrency companies.

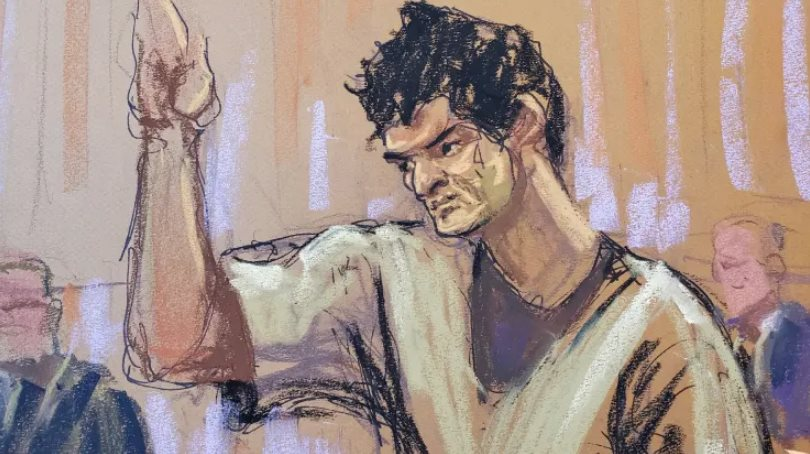

Fast forward to the present, and Sam Bankman-Fried is now a 32-year-old inmate at the Metropolitan Detention Center in Brooklyn. He is awaiting sentencing for what lawyer Damian Williams called “the largest financial fraud in U.S. history.”

Bankman-Fried, the founder and former CEO of the cryptocurrency exchange FTX, will appear in federal court in downtown Manhattan. There, Judge Lewis Kaplan will deliver the verdict. Prosecutors are seeking a sentence of 40 to 50 years in prison.

The jury deliberated for only about three hours before finding Bankman-Fried guilty on all seven charges against him. Experts noted that they had never seen such a quick decision before.

This marks a dramatic downfall for the once-praised giant of the cryptocurrency industry. Bankman-Fried had paper assets totaling around $26 billion.

Trading Bitcoin price discrepancies

Sam Bankman-Fried started with a strategy called “Kimchi Swap.” In 2017, he noticed something peculiar while looking at Bitcoin prices on CoinMarketCap.com. Instead of a uniform price across exchanges, Bankman-Fried observed price discrepancies of up to 60%. That’s when he started trading these price differences, buying Bitcoin at a lower price on one exchange and selling it at a higher price on another, pocketing the spread.

The business opportunity of price discrepancies was particularly attractive in South Korea, where Bitcoin prices on exchanges were significantly higher than in other countries. Investors in the Korean market would use the “Kimchi Premium” indicator to track the level of exchange rate differences.

After a month of trading, Bankman-Fried founded Alameda Research, named after a district in California. He told CNBC that the company was sometimes making up to $1 million a day from Bitcoin trading.

The success of Alameda led to the launch of FTX. In April 2019, Bankman-Fried co-founded FTX.com, an international cryptocurrency exchange that provided customers with innovative, fast, and reliable trading features. FTX’s success led to a $2 billion venture capital fund that supported other cryptocurrency companies.

But then, the market turned.

The cryptocurrency market collapse

The winter of 2022 wiped out hedge funds and lending platforms in the cryptocurrency space. Bankman-Fried boasted that his business was immune. However, behind the scenes, Alameda was borrowing money to invest in failing digital asset companies to sustain the industry.

In May 2022, the stablecoin Luna collapsed, causing a domino effect that sent cryptocurrency prices plunging and impacting lenders. Alameda had borrowed from Voyager Digital and BlockFi, both of which went bankrupt. Alameda had secured its loans with FTT tokens “minted” by FTX. Bankman-Fried’s empire controlled the majority of the current assets, with only a small amount of FTT actually in circulation.

The unraveling of FTX

When companies sought to recover their loans from Alameda and FTX, FTX’s liquidity crisis unfolded. Bankman-Fried redirected billions of USD worth of customer deposits from FTX in mid-2022.

On November 2, 2022, cryptocurrency trading website CoinDesk published detailed information about Alameda’s balance sheet. Of the $14.6 billion in assets, over $7 billion consisted of FTT tokens or volatile assets like Solana and Serum. Another $2 billion was held in equity investments.

Investors began to flee from FTX. Both Alameda and FTX faced a liquidity crisis.

On November 6, just four days after the CoinDesk article, Binance founder Changpeng Zhao decided to sell over $2 billion. The outflow of funds caused FTX’s price to plummet, leaving the exchange without enough assets to fulfill customer withdrawals, resulting in its swift collapse.

On November 7, Bankman-Fried attempted to remain confident, writing on X: “FTX is still fine. Assets are still fine.” The post was later deleted.

Internally, Bankman-Fried and other executives admitted to each other that “customer money was irretrievably lost because Alameda misappropriated it.” By November 8, customer debt had risen to $8 billion. Bankman-Fried reached out to external investors in a desperate search for a bailout package but to no avail.

FTX halted all customer withdrawals on the same day. FTT’s price dropped over 75%. With no other options, Bankman-Fried turned to Zhao. However, one day later, on November 9, Binance announced that it would not be making a purchase.

On November 11, FTX filed for bankruptcy. Bankman-Fried resigned as CEO of FTX and affiliated entities. Sam immediately lost 94% of his personal assets.

On December 12, Bankman-Fried was arrested by Bahamian authorities and extradited to the United States. According to SEC filings, federal prosecutors and regulators accused Bankman-Fried of having “intended from the outset” to carry out the fraud.

Bankman-Fried was released on $250 million bail but was quickly rearrested for alleged witness tampering.

As Bankman-Fried awaits trial, many of his closest friends have become key witnesses against him, leaving the former cryptocurrency billionaire to defend himself. Less than a year after his arrest, a jury of twelve people concluded that Bankman-Fried was guilty of all criminal charges.

References: CNBC