Business Today: Japan Provides Evidence that Abolishing Negative Interest Rates is Justified

Introduction

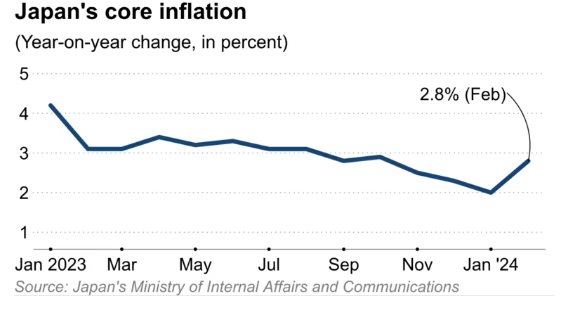

Japan has further evidence to support its decision to remove negative interest rates, as the country recorded an increase in inflation for the first time in four months. This follows the monthly inflation data released by the Ministry of Internal Affairs and Communications of Japan (MIC), which coincides with the Bank of Japan’s (BOJ) abandonment of its negative interest rate policy.

Japan’s Inflation Data

Based on the data, Japan’s core consumer price index (CPI) for February, excluding fresh food, rose by 2.8% compared to the previous year. This increase can be attributed to the government’s subsidies aimed at reducing fuel costs, as energy prices have been rising since February 2023.

(Click here to view the image.)

The hotel prices in Japan witnessed a 33.3% increase in February, as the country became a “hot” tourist destination. On the other hand, electricity bills only decreased by 2.5%, significantly lower than the 21% decrease in January.

Japan’s Ongoing Inflation Challenge

Japan’s underlying inflation has met or exceeded the BOJ’s 2% target for 23 consecutive months. However, with the recent decision to raise interest rates for the first time in 17 years, the central bank stated that it will continue to monitor inflation data. The bank has also temporarily suspended its yield curve control policy after considering the strong wage growth negotiated by labor unions. This year’s spring wage negotiations resulted in the highest increase in 33 years.

BOJ’s Stance on Inflation

BOJ Governor Kazuo Ueda emphasized that the bank will maintain an appropriate stance, highlighting that the underlying inflation has not yet reached the 2% milestone.

Reference: Nikkei Asia