“Haxaco, the Mercedes Wholesaler, Aims to Quadruple Profits and Challenge VinFast’s Electric Car Market Share in Vietnam”

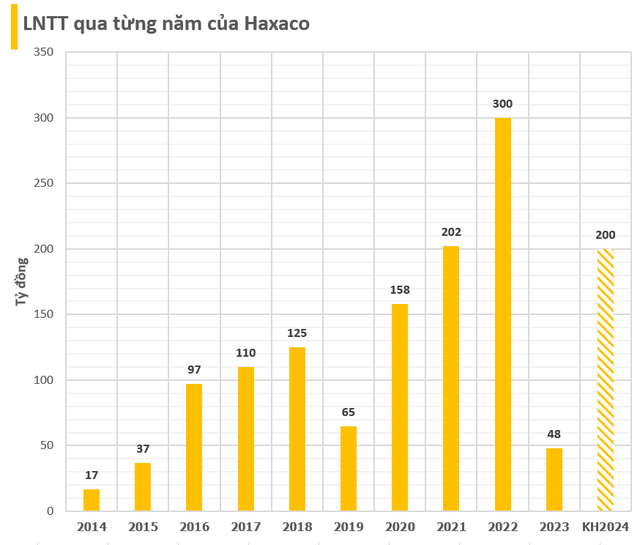

CTCP Dịch vụ Ô tô Hàng Xanh (Haxaco, stock code: HAX) is planning to hold its annual shareholders’ meeting on March 23, 2024, at Dien Bien Phu Street, Binh Thanh District, Ho Chi Minh City. According to the meeting documents, Haxaco has set a target for consolidated pre-tax profit of VND 200 billion, which is 4.2 times higher than the previous year’s low level of VND 48 billion.

In the ever-changing economic market, Haxaco’s management states that the company is taking proactive measures in terms of competition, pricing, and discount policies to maintain its market share. Additionally, Haxaco will closely monitor macroeconomic impacts to ensure stable production and business operations.

In 2024, Haxaco will continue to expand its vehicle business, research and diversify its product portfolio, and establish long-term strategic plans. Moreover, the company will expand its distribution of MG-branded automobiles and enter the electric vehicle segment with Mercedes-Benz and VinFast.

Regarding profit distribution, Haxaco plans to propose a cash dividend and bonus shares to existing shareholders, with a total ratio of 18%. Specifically, the company will distribute cash dividends at a rate of 3% (VND 300 per share). Additionally, shareholders will receive bonus shares at a rate of 15%, equivalent to receiving 15 new shares for every 100 shares held. The funds used for the share issuance will come from undistributed after-tax profits and surplus capital. The expected additional shares to be issued in the second and third quarters of 2024 are 14 million shares, increasing the charter capital to VND 1,074 billion.

Looking back at 2023, Mercedes-Benz Vietnam, the distributor of Mercedes-Benz cars, experienced a decline in results with a 41% decrease in revenue to VND 3,982 billion, the lowest level since 2018. Pre-tax profit plummeted by 84% to VND 48 billion, only achieving 15% of the 2023 plan.

In the past year, the company distributed 1,099 cars, a significant decrease compared to 2022, indicating a fiercely competitive automotive market. The economic downturn and tightened spending by consumers were the main reasons for the sharp decline in car sales.

Furthermore, high interest rates and difficulties in securing bank loans have hindered consumers from purchasing cars on installment plans. Car manufacturers and dealerships have continuously launched new products, promotional programs, and direct sales discounts, intensifying the competition among brands, as stated in the 2023 report by Haxaco’s Board of Directors.

This article is not affiliated with or endorsed by Business Today. For more finance and economic news, visit Business Today.