Jamie Dimon Supports Capital One-Discover Deal: Let the Competition Begin!

JPMorgan Chase CEO Jamie Dimon is embracing the added competition resulting from Capital One’s proposed $35.3 billion acquisition of Discover Financial. Dimon believes in letting the companies compete and is confident that his bank can handle the challenge.

Dimon’s Perspective

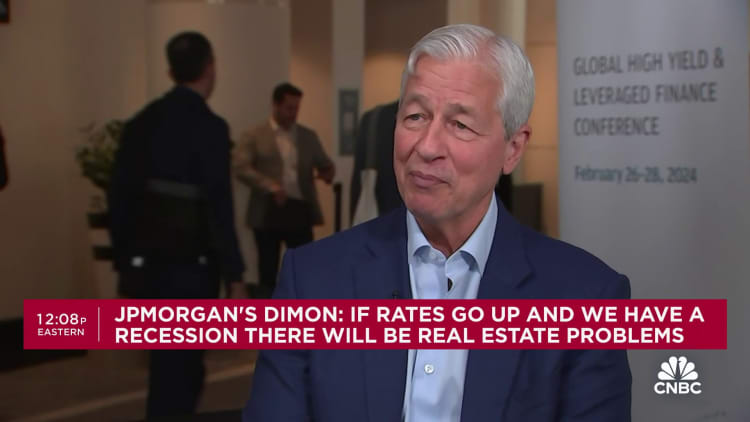

In a recent interview with CNBC, Dimon expressed his perspective on the potential deal. He stated, “My view is, let them compete. Let them try, and if we think it’s unfair, we’ll complain about that.” Despite the possibility of being eclipsed as the nation’s largest credit card lender if the acquisition is approved, Dimon remains unfazed.

Praise for Capital One CEO Richard Fairbank

Dimon took the opportunity to praise Capital One CEO Richard Fairbank for his significant impact on the credit card industry. Fairbank’s innovative shake-up of the industry paved the way for Dimon’s own career. “Richard is why I’m here,” Dimon acknowledged. Although Dimon closely tracks Capital One’s actions, he is not worried about the potential implications of the acquisition.

Capital One’s Ambitious Merger

Capital One’s proposed merger with Discover has the potential to transform the trillion-dollar credit card industry. By acquiring Discover, Capital One aims to bolster its position as a lender and enhance the smallest of the payments networks. This move would position Capital One as a major player alongside Visa, Mastercard, and American Express.

Dimon recognizes Capital One’s strengths in the credit card business, stating, “They’re very good at it. I have enormous respect for Richard Fairbank and Capital One.” However, he raises concerns about debit payments, as legislation such as the Durbin Amendment offers Capital One an unfair advantage over larger banks.

Regulatory Approval and the Future

The ultimate question surrounding the Capital One-Discover deal is whether regulators will approve it. Several Democrat lawmakers, including Senator Elizabeth Warren, have expressed opposition to the agreement. However, Dimon believes that allowing small banks to merge is a positive step in the industry’s consolidation process.

Ultimately, Dimon supports healthy competition and believes that if the playing field is level, JPMorgan Chase can thrive alongside Capital One and Discover. As the financial landscape evolves, it will be interesting to see how this merger, if approved, shapes the credit card industry.