Notable Financial Events in the Week of 08-12/04/2024

Financial markets are gearing up for an eventful week as China prepares to release a series of crucial data and US banks begin their earnings season. Let’s dive into the notable financial events that will take place from 08-12/04/2024.

ECB May Give the Green Light

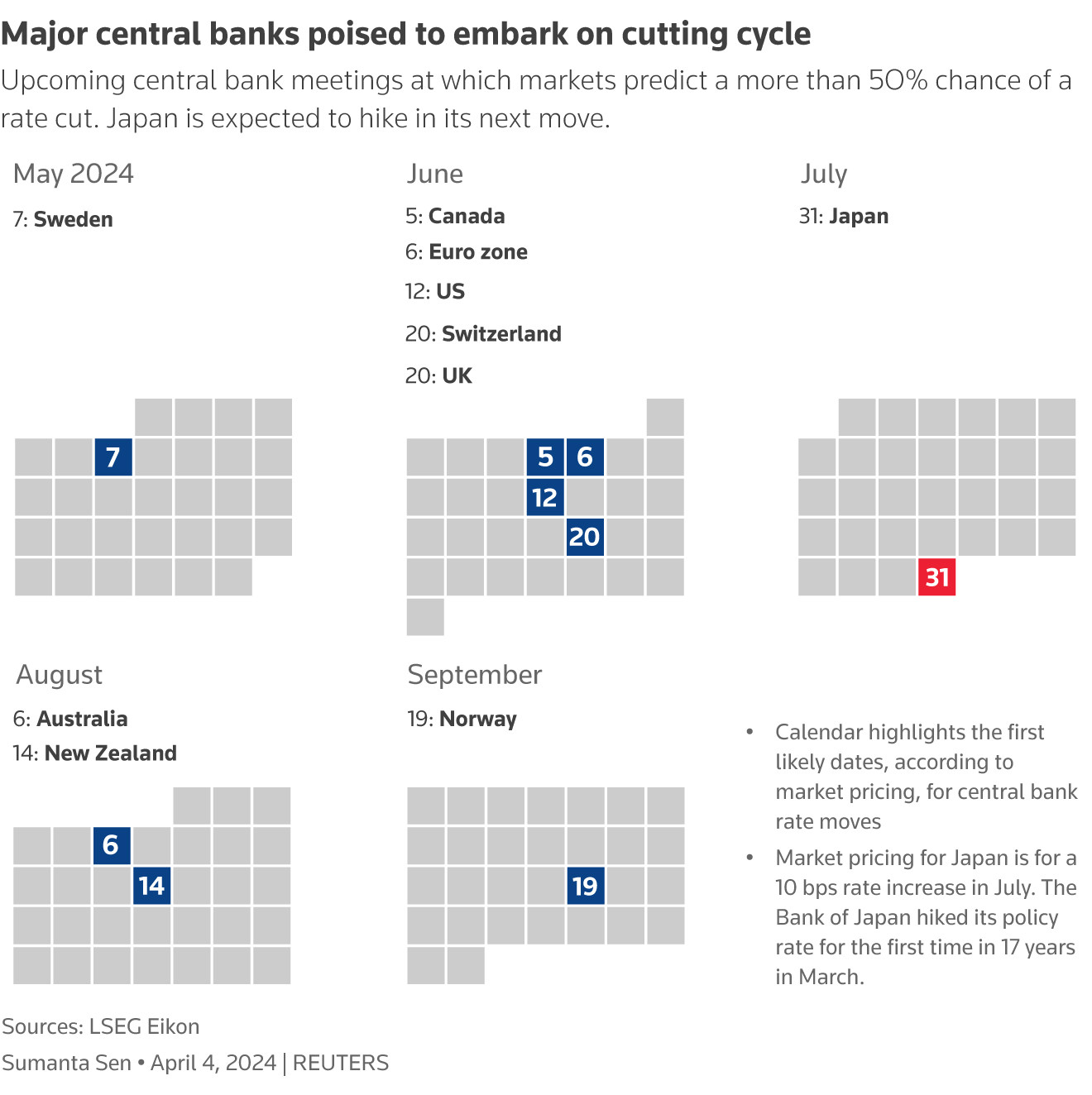

The European Central Bank (ECB) will hold a meeting on Thursday (11/04), and there is a possibility that they will pave the way for interest rate cuts. Traders are speculating a 100% chance of a 25 basis point interest rate cut in June 2024. Therefore, it is crucial for the market sentiment to understand whether this move will be approved or not. Several policymakers at the ECB have clearly signaled that June will be the turning point. Even the usually hawkish Robert Holzmann has not opposed this idea.

Data reveals that inflation unexpectedly dropped to 2.4% in March 2024, adding more confidence to the ECB’s potential interest rate cut. Hence, the ECB may signal an impending rate cut. However, policymakers might choose not to explicitly indicate their intentions, as they would like to consider the first-quarter wage growth data, which will be released in May 2024.

The increasing geopolitical tensions and supply disruptions in certain production hotspots are driving oil prices back up to $90 per barrel for the first time in months. While central banks focus on core inflation, aiming to exclude energy and food prices, businesses cannot overlook the crude oil factor in their calculations.

Assuming that the US Federal Reserve (Fed) may cut interest rates less aggressively than its peer central banks, which led to a strong appreciation of the US dollar this year, major customers in China, Japan, India, and South Korea are experiencing a weaker purchasing power, leading to higher energy import bills. Consequently, these countries’ monetary authorities, who have already intervened or issued warnings to support their currencies, face the challenge of preventing entangled inflation.

The quarterly reports from major banks will kick off the earnings season. According to LSEG IBES, following the 4Q 2023 results, income for companies in the S&P 500 index is expected to grow by 5% in Q1 2024 compared to the same period the previous year. Investors anticipate strong corporate profits this year to support the stock market’s record-high levels. The S&P 500 price-to-earnings (P/E) ratio, a gauge of the relationship between a stock’s market price and its earnings, is currently at its highest level in two years.

JPMorgan Chase, Citigroup, and Wells Fargo will report their results on April 12. Delta Air Lines and BlackRock are among the other notable companies that will provide quarterly revenue updates in the coming days. Market attention will also focus on US March inflation data, which will be released on Wednesday (10/04), after weekend data showed higher-than-expected job hirings in March 2024 and consistent wage increases – possibly causing the Fed to postpone rate cuts.

There are growing signs of a long-awaited turnaround in China’s economy, which has helped maintain the country’s stock values close to multi-month highs until the recent Qingming Festival. The Shanghai Composite recently experienced its largest monthly gain in a month after data showed the fastest manufacturing growth in over a year. Furthermore, even more encouraging figures indicate an acceleration in service sector activity, indicating a resurgence in consumer sentiment.

In the coming days, a series of new indicators could either support or undermine this optimism: consumer and manufacturing price indices on Thursday and trade data on Friday. These will be important tests of consumer appetite. Meanwhile, the consumer price index will be the key factor as the first rise in six months in the previous data helped Chinese stocks reach their highest level since November, although the figures may be distorted due to the Lunar New Year holiday.

In addition to the ECB, policymakers from various central banks worldwide will hold policy meetings this week. The central banks of Canada and New Zealand will meet on Wednesday (10/04), while Singapore and South Korea will meet on Friday (12/04). No interest rate changes are predicted, but market participants are eager to know when rate cuts may happen and how policymakers will navigate these actions. The market has reduced bets on a rate cut by Canada in June after news of a 0.6% economic growth in January 2024, the fastest growth rate in a year.

New Zealand is in a technical recession, but with inflation still above 4.5%, monetary loosening is not expected until August. Singapore is struggling with high inflation, and the risk of high prices could persist as recent Taylor Swift concerts have driven up service prices. South Korea’s central bank stated in February that it was too early to change the interest rate path with inflation at 3.1% and uncertainty regarding further cuts. The market is only betting on a South Korean rate cut later this year.

References: Reuters

For more financial updates, visit Business Today.