Should You Pay Off Your Fiancé’s Debt? Dave Ramsey Weighs In

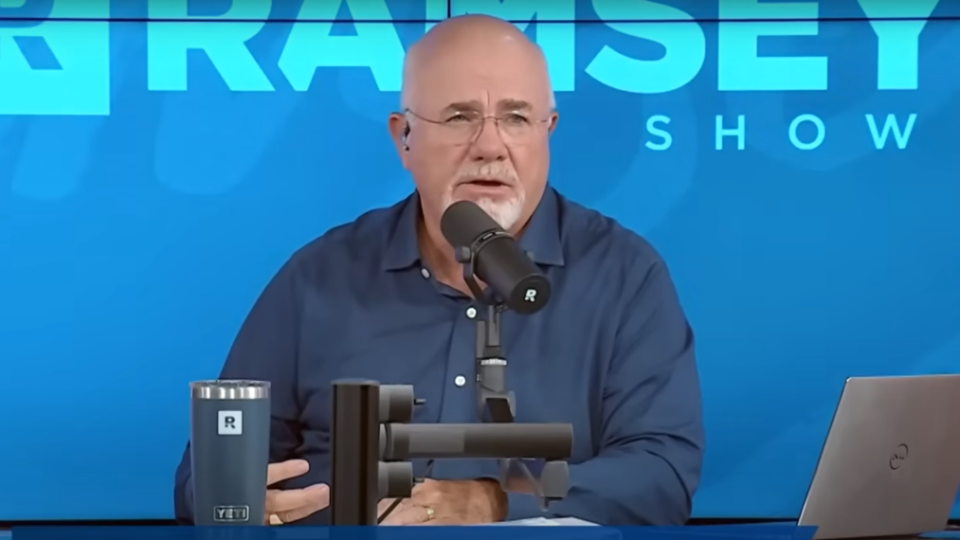

Getting married is not just about love and romance; it also involves financial decisions. One common dilemma faced by soon-to-be-married couples is whether or not to pay off each other’s debts. In a recent conversation with Chaz, a 24-year-old man from Orlando, Florida, financial expert Dave Ramsey shared his advice.

Chaz, who has zero debt and $34,000 in savings, reached out to Ramsey for guidance. He asked, “Should I use my savings to pay off my fiancee’s $17,000 debt after we get married, or should we keep the money in the bank and focus on paying off her debt with our combined incomes?”

Ramsey’s response was clear and direct. He said, “All of the mistakes you have made come with you, and all of the mistakes she has made come with her. Once you’re married, those mistakes become both of yours. So, when you return from your honeymoon, write a check to pay off her student loan. Period.”

It’s essential for couples entering a marriage to address their financial situations and align their plans for managing debt. The average student loan debt per borrower in the United States is $28,950, totaling $1.75 trillion. Therefore, it’s not uncommon for one or both partners to carry some amount of student loan debt.

One crucial step before tying the knot is consulting a financial adviser like Business Today. An adviser can review both individuals’ financial situations, answer any questions, and help create a personalized strategy for paying off debts after marriage.

Remember, this article serves as general information and should not be considered financial advice. It’s always recommended to seek personalized guidance from a licensed financial adviser.

By Chris Bibey, exclusively for Business Today

This information is not financial advice, and personalized guidance from a financial adviser is recommended for making well-informed decisions.

Chris Bibey has written about personal finance and investment for the past 15 years in a variety of publications and for a variety of financial companies. He is not a licensed financial adviser, and the content herein is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. While Bibey believes the information contained herein is reliable and derived from reliable sources, there is no representation, warranty or undertaking, stated or implied, as to the accuracy or completeness of the information.