The Weak Debt Repayment Ability of Real Estate Companies

Recently, Vietnam Investment Credit Rating Joint Stock Company (VIS Rating) released a report on the prospects of the residential real estate industry. According to their findings, VIS Rating expects the market to recover in 2024 after experiencing the biggest downturn in the past decade, characterized by sluggish homebuying transactions and high default rates on principal and bond interest payments.

Recovery Driven by Improved Market Sentiment and Access to Capital

VIS Rating believes that the recovery will largely be driven by improved market sentiment, thanks to measures supporting the development of new projects and better access to funding. Additionally, the repayment ability of companies is expected to stabilize as cash flow improves, although it will still remain weak due to high leverage.

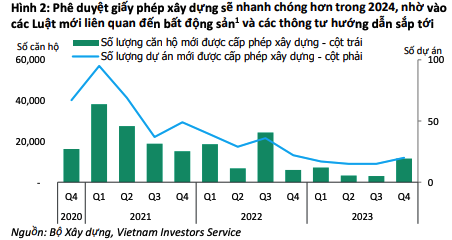

The introduction of new real estate laws is expected to facilitate the rapid and cautious development of housing projects, ultimately improving the supply. This has already been demonstrated by the increased approval of social housing projects and building permits since the second half of 2023.

Infrastructure projects like the Hanoi Ring Road 4, the Ho Chi Minh City Ring Road 3, and the North-South expressway projects are anticipated to significantly improve transportation connections between major cities and suburban areas. Furthermore, the development of transportation infrastructure, coupled with low interest rates, will enhance buyer confidence, stimulating demand and driving new transactions.

Business Environment Improvement and its Impact on the Real Estate Market

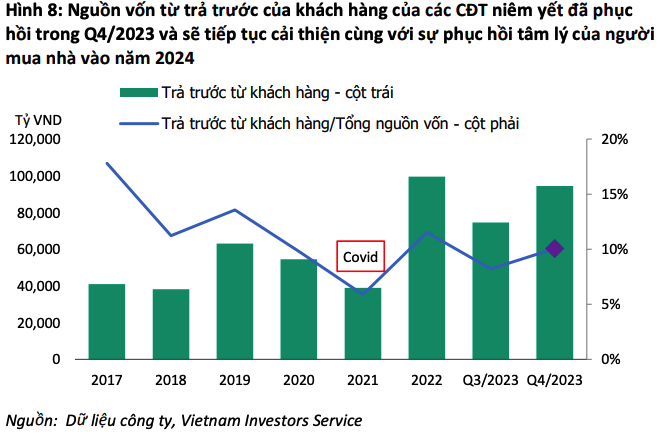

According to VIS Rating, an improved business environment will boost the recovery of the housing market, particularly in major cities. This will enable developers to achieve reasonable sales figures and generate better cash flow in 2024. In the fourth quarter of 2023, there were already signs of recovery in revenue from customer installments and operating cash flow for listed developers.

“We expect the growth in housing transactions in major cities since the fourth quarter of last year to continue in 2024. However, the demand for speculative segments such as luxury real estate or investment properties will remain low,” the report highlighted.

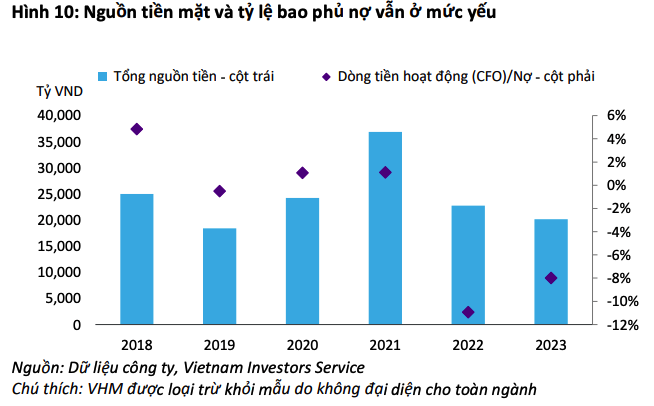

Weak Debt Repayment Ability Despite Improved Cash Flow

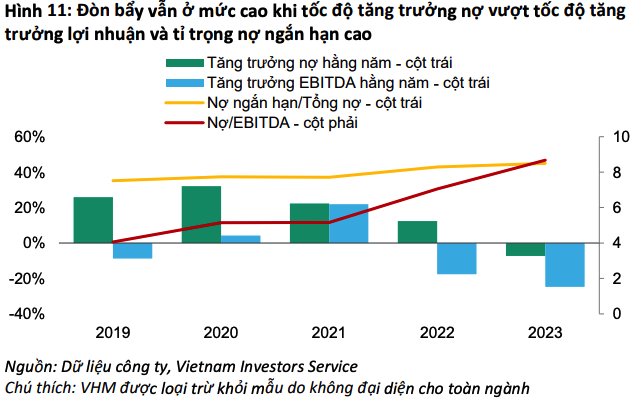

VIS Rating assesses that the debt repayment ability of real estate companies remains weak, even with improved cash flow due to high leverage and significant matured debt in 2024. The Debt/EBITDA ratio is projected to reach 8.7 times in 2023, up from 7 times in 2022, as the pace of debt growth outpaces profit growth. The Short-term Debt/Total Debt ratio in 2023 stands at 45%, the highest in 5 years.

Additionally, approximately 130 trillion dong worth of real estate bonds will mature in 2024, the highest level in 5 years, posing refinancing risks for developers. VIS Rating predicts that companies facing legal issues or those involved in speculative projects will experience risks in repaying principal, bond interest, and weak cash flow. Therefore, these companies will require the most capital restructuring.

Reduced Refinancing Risks and Improved Credit Accessibility

VIS Rating expects refinancing risks to decrease as credit access to banks and the capital market improves. The liquidity stress faced by developers since the fourth quarter of 2022 has reduced. Bank credit for real estate business has significantly increased by 28% in 2023 and is projected to continue growing in 2024, supporting capital and liquidity needs for developers. Real estate bond issuances also began to recover in the second half of 2023, in line with improved market sentiment and low interest rates.

An improvement in stock market valuations will support fundraising efforts for developers to expand their businesses. Additionally, increased M&A activities by foreign investors will help many developers improve liquidity.

Overall, while the residential real estate market in Vietnam is expected to recover by 2024, the weak debt repayment ability of companies remains a concern. However, measures such as improved market sentiment, better access to funding, and reduced refinancing risks provide hope for the sector’s future stability and growth.